Understanding the No-Fault System

Michigan’s no-fault insurance system is designed to simplify the claims process by eliminating the need to determine fault in an accident. However, this system has been subject to debate and reform efforts. The system is intended to provide quick access to medical treatment and rehabilitation, but it has led to higher insurance costs compared to other states with fault-based systems. The high costs are attributed to factors such as unlimited personal injury protection (PIP) coverage and high medical costs.

History and Purpose

Established in 1973, the no-fault system was designed to streamline claims handling, allowing drivers to receive compensation for injuries without the hassle of determining fault. This system aims to provide immediate medical benefits to injured parties, regardless of who caused the accident. It was created to reduce the time and legal costs associated with determining fault, facilitating quicker access to medical care and rehabilitation for injured individuals.

Recent Changes

The recent amendments to Michigan’s no-fault law, implemented in 2019, introduced flexibility in PIP coverage options. Drivers can now choose limited PIP coverage, with options as low as $50,000, or opt-out if they have qualifying health insurance. While this provides potential savings on premiums, it also comes with risks, as lower coverage limits may lead to significant out-of-pocket expenses in the event of severe injuries. These changes were enacted in response to longstanding criticism regarding Michigan’s high insurance rates, aiming to make coverage more affordable while still providing essential protection.

Benefits and Risks

Unlimited PIP coverage offers comprehensive medical benefits, ensuring that serious injuries are covered. However, it comes with higher premiums that may not be necessary for everyone. Limited PIP can lower costs but increases the risk of out-of-pocket expenses for serious injuries, making it crucial for drivers to assess their needs carefully. For instance, if you have robust health insurance that covers accidents, opting for limited PIP may be a financially prudent choice. Conversely, those without adequate health coverage might find the unlimited option more beneficial, despite the higher cost.

Impact on Insurance Costs

The no-fault system has contributed to Michigan having some of the highest car insurance rates in the nation. Understanding how this system works can help drivers make informed decisions about their coverage and potentially save money. According to the Michigan Catastrophic Claims Association, the average annual premium for full coverage car insurance in Michigan was approximately $3,141 in 2023, significantly higher than the national average. This expense can be a burden for many residents, prompting the need for strategic planning when selecting insurance.

Key Factors Affecting Car Insurance Rates in Michigan

Several critical factors significantly influence car insurance rates in Michigan. Understanding these elements can help you navigate the insurance landscape and find the best car insurance in Michigan for your needs.

Driving Record

Your driving history is one of the most important factors insurers consider when setting your rates. A clean record with no accidents, speeding tickets, or DUIs can lead to lower premiums. On the other hand, a history of violations can significantly increase costs, particularly for younger drivers. A significant factor contributing to higher insurance rates for young drivers is the statistical correlation between age and risk. Insurance companies use actuarial data to show that drivers under 25 have a higher likelihood of accidents, leading to higher premiums. For example, a single speeding ticket can raise your premium by an average of 20%. Therefore, maintaining a clean driving record is essential not only for safety but also for financial savings on your insurance.

Vehicle Type

The make and model of your vehicle can also affect your insurance rates. Insurers often view certain vehicles as being more prone to accidents or costly repairs, which can lead to higher premiums. For instance, sports cars and luxury vehicles typically come with higher insurance costs due to their performance capabilities and repair expenses. Choosing a vehicle with strong safety ratings and lower repair costs can help you save on your coverage. Additionally, vehicles equipped with advanced safety features, such as automatic braking and collision detection, may qualify for discounts.

1. https://hidanang.vn/mmoga-securing-the-cheapest-car-insurance-in-oregon-a-comprehensive-guide

2. https://hidanang.vn/mmoga-finding-the-top-real-estate-agents-in-your-area-a-comprehensive-guide

3. https://hidanang.vn/mmoga-unlock-the-cheapest-car-insurance-in-missouri-a-comprehensive-guide

4. https://hidanang.vn/mmoga-cheap-car-insurance-arizona-tips-for-affordable-rates-in-2024

5. https://hidanang.vn/mmoga-cheap-car-insurance-houston-find-the-best-rates-for-your-budget

Age and Experience

Younger, less experienced drivers typically pay more for car insurance in Michigan. Statistics show that drivers under 25 face substantially higher rates due to their perceived risk. As you gain experience and demonstrate a safe driving record over time, your rates are likely to decrease, reflecting the reduced risk you pose to insurers. For instance, many insurers offer significant discounts for drivers over the age of 25 or for those who have completed driver education courses.

Location

Where you live in Michigan can greatly impact your insurance costs. Urban areas, particularly cities like Detroit, often see higher premiums due to increased accident rates, vehicle theft, and other risk factors associated with densely populated regions. Conversely, rural drivers may enjoy lower rates due to decreased risk. Factors such as crime rates, traffic congestion, and even weather patterns can also play a role in determining insurance premiums. For example, areas prone to severe weather events may see higher rates due to the increased likelihood of vehicle damage.

Credit Score

While Michigan law prohibits insurers from using credit scores to deny coverage, your credit history can still influence your rates to some extent. Maintaining a good credit score can help you secure more favorable car insurance prices and discounts. Insurers often view individuals with better credit as lower-risk clients, which can translate into lower premiums. Therefore, it’s wise to monitor your credit score and take steps to improve it if necessary, such as paying bills on time and reducing debt.

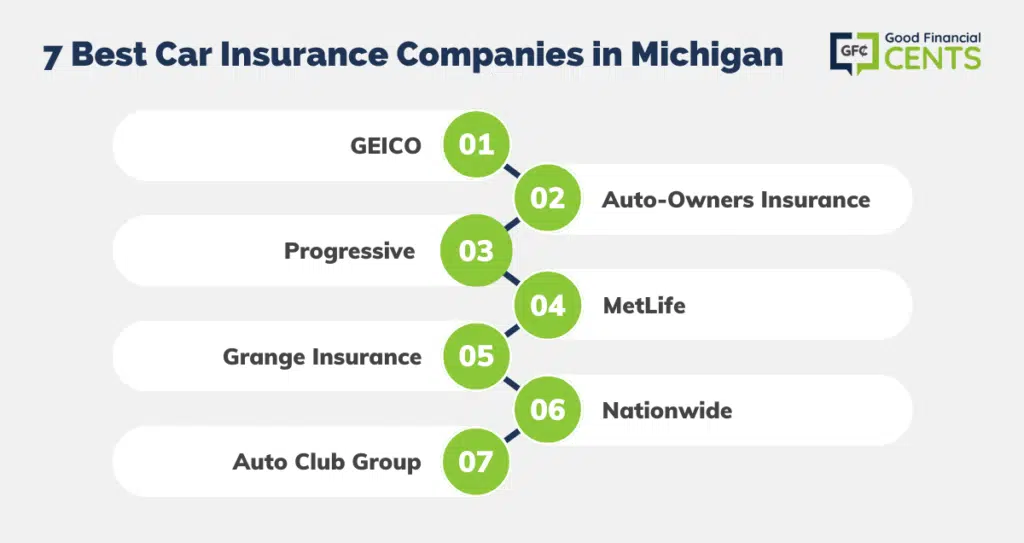

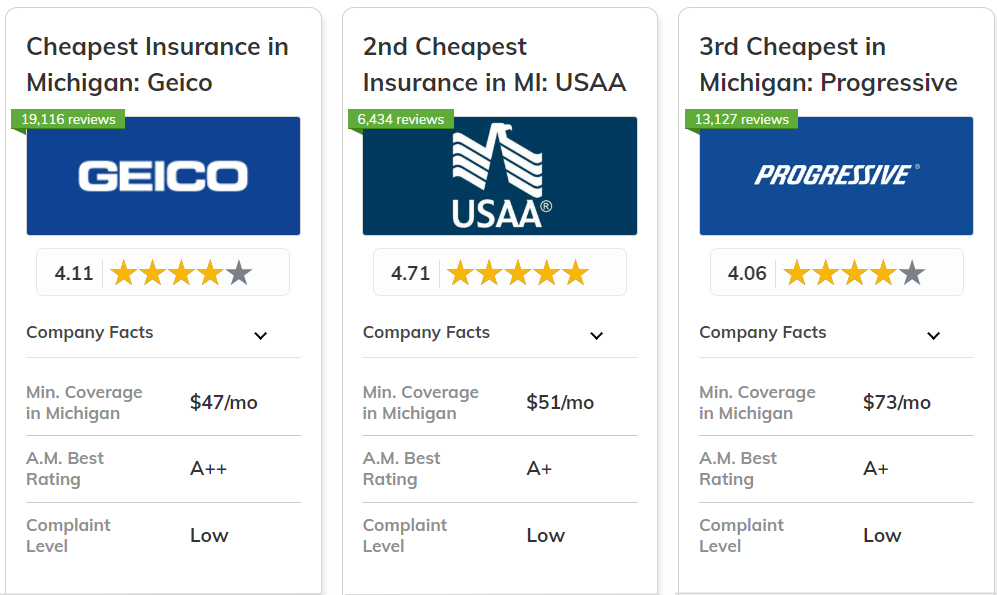

Top Car Insurance Companies for the Best Car Insurance in Michigan

These companies provide a range of coverage options and potential discounts, making it worthwhile to shop around for the best car insurance Michigan that fits your needs and budget. Each insurer has its strengths, so consider what factors are most important to you—be it price, coverage options, or customer service.

Recent trends in Michigan’s car insurance market include the increasing adoption of telematics, also known as usage-based insurance. These programs track driving habits using devices or smartphone apps, offering discounts to drivers who demonstrate safe driving practices. Additionally, the rise of electric vehicles (EVs) is influencing insurance rates. Some insurers offer discounts for EVs due to their safety features and lower maintenance costs.

Tips for Getting the Best Car Insurance Rates in Michigan

To secure the most affordable and comprehensive car insurance in Michigan, consider these practical strategies:

- Shop Around: Instead of settling for the first quote you receive, take the time to compare rates from multiple insurers. This can lead to significant savings, as premiums can vary widely. Online comparison tools can streamline this process, allowing you to evaluate multiple quotes quickly.

- Negotiate: Don’t hesitate to negotiate with insurance agents for better rates. Present evidence of your clean driving record or other factors that may qualify you for discounts. Many companies are willing to work with you to retain your business.

- Bundle Policies: Look for opportunities to bundle your car insurance with other policies, such as homeowners or renters insurance, to take advantage of multi-policy discounts. Many insurers offer significant savings for bundling, which can result in lower overall premiums.

- Increase Deductibles: Raising your collision and comprehensive deductibles can significantly lower your premiums. Ensure you can cover the higher out-of-pocket costs if you need to file a claim. This strategy works best for those who have the financial capacity to handle potential higher costs in the event of an accident.

- Consider Limited PIP: Evaluate your PIP coverage needs and determine if a lower, limited option may be sufficient to save on your premiums. If you have other health insurance that covers injuries, a limited PIP may be the right choice. However, while opting for limited PIP coverage can lower premiums, it’s crucial to consider the potential financial risk. In the event of a serious accident, limited coverage may not be sufficient to cover all medical expenses, leaving individuals with substantial out-of-pocket costs. It’s essential to assess personal financial circumstances and health insurance coverage before making this decision.

- Take Defensive Driving Courses: Many insurers offer discounts for completing approved defensive driving programs, which can help offset the cost of your coverage. Not only does this improve your driving skills, but it can also make you a more attractive candidate for lower rates.

- Maintain a Clean Driving Record: Avoiding accidents and violations is key to keeping your car insurance rates low. Consider setting reminders for maintenance and safe driving practices to help ensure your record remains clean.

- Review Your Coverage Regularly: Life changes such as moving, getting married, or purchasing a new vehicle can all impact your insurance needs. Regularly reviewing your coverage can help you ensure you’re not overpaying for unnecessary coverage.

- Utilize Discounts: Be aware of all the discounts that may be available to you. Many insurers offer discounts for good students, military service, low mileage, and even for vehicles equipped with certain safety features.

By implementing these tips, Michigan drivers can take control of their car insurance costs and find the coverage that best meets their needs.

Frequently Asked Questions

Q: How much is car insurance in Michigan?

A: The average cost of car insurance in Michigan is approximately $3,141 per year for full coverage, or about $262 per month. However, rates can vary significantly based on factors like age, driving record, vehicle type, and location within the state.

1. https://hidanang.vn/mmoga-cheap-car-insurance-arizona-tips-for-affordable-rates-in-2024

2. https://hidanang.vn/mmoga-unlock-the-cheapest-car-insurance-in-missouri-a-comprehensive-guide

3. https://hidanang.vn/mmoga-cheap-car-insurance-houston-find-the-best-rates-for-your-budget

4. https://hidanang.vn/mmoga-finding-the-top-real-estate-agents-in-your-area-a-comprehensive-guide

5. https://hidanang.vn/mmoga-securing-the-cheapest-car-insurance-in-oregon-a-comprehensive-guide

Q: What are the minimum car insurance requirements in Michigan?

A: Michigan requires drivers to carry the following minimum insurance coverage:

- Personal Injury Protection (PIP): $50,000 or more

- Bodily Injury Liability: $50,000 per person/$100,000 per accident

- Property Damage Liability: $10,000 per accident

- Property Protection Insurance: $1 million

Q: How can I lower my car insurance rates after a DUI?

A: To reduce your car insurance costs after a DUI, maintain a clean driving record, take defensive driving courses, and shop around for insurers that may be more lenient with past infractions. Additionally, consider enrolling in alcohol education programs, as some insurers may offer discounts for completing them.

Q: What should I do if I get into a car accident in Michigan?

A: If you’re involved in an accident, report it to your insurance provider as soon as possible. Provide details about the incident, any injuries or damages, and the other parties involved. Depending on the circumstances, consulting a personal injury attorney may also be advisable to ensure you receive all entitled benefits under Michigan’s no-fault laws.

Q: What is the best car insurance company for young drivers in Michigan?

A: The best car insurance company for young drivers can vary based on individual circumstances. USAA and GEICO often provide competitive rates, but it’s essential to compare quotes from multiple insurers to find the best fit. Young drivers should also look for companies that offer good student discounts or safe driving programs.

Conclusion

Finding the best car insurance in Michigan requires a solid understanding of the state’s unique insurance landscape, the key factors affecting rates, and a thorough comparison of offerings from top providers. By following the tips discussed in this guide, you can secure comprehensive coverage at an affordable price. Don’t forget to shop around, negotiate, maintain a clean driving record, and take advantage of available discounts. Start comparing quotes today and discover the best car insurance for your needs. With careful planning and informed choices, you can navigate the complexities of Michigan’s car insurance market with confidence and peace of mind.