Navigating the car insurance market in Oregon, particularly for young drivers, can indeed feel like a complex maze. The financial burden of coverage can be substantial, with insurance premiums frequently being quite high for those who are newer to driving. However, it’s important to know that securing cheap car insurance in Oregon is definitely achievable. It requires a thoughtful and strategic approach, focusing on understanding the various elements that influence insurance rates and identifying the insurance providers that offer the most competitive deals in the state.

Toc

- 1. Understanding the Cost Factors for Cheap Car Insurance in Oregon

- 2. Cheap Car Insurance Oregon: Affordable Providers for Young Drivers

- 3. Related articles 01:

- 4. Tips for Finding the Cheapest Car Insurance as a Young Driver in Oregon

- 5. Related articles 02:

- 6. Frequently Asked Questions

- 7. Additional Considerations for Young Drivers in Oregon

- 8. Conclusion

In this comprehensive guide, we will delve into the crucial factors that insurance companies consider when determining your car insurance rates in Oregon. We will also highlight some of the companies that consistently offer the cheapest car insurance options to drivers in the state. Furthermore, we will equip you with practical and actionable tips that you can implement immediately to help you significantly reduce your overall car insurance costs, ensuring you find the most affordable coverage that meets your individual needs and circumstances as a driver in Oregon.

Understanding the Cost Factors for Cheap Car Insurance in Oregon

When it comes to finding the cheapest car insurance in Oregon, several key factors influence your premiums. Understanding these factors can help you make informed decisions and potentially lower your costs.

Age

Age is one of the most significant determinants of car insurance rates. Insurers view younger drivers as higher-risk based on statistical data showing that they are more likely to be involved in accidents. For instance, the average annual cost of a full coverage policy for a 16-year-old driver in Oregon can range from $5,340 to $6,036. In contrast, a 35-year-old driver typically pays around $2,408 for the same coverage. This stark difference emphasizes the importance of exploring ways to lower your insurance costs as a young driver.

Insurance companies rely on actuarial data, which is collected and analyzed over time to predict future events. This data shows that young drivers are statistically more likely to be involved in accidents, leading to higher insurance premiums. This is due to factors like lack of experience, higher risk-taking behavior, and less developed driving skills. However, some insurance companies offer discounts to young drivers who complete a state-approved defensive driving course. These courses teach safe driving techniques and can demonstrate a commitment to responsible driving behavior, potentially leading to lower premiums.

Driving History

Your driving history plays a crucial role in determining your car insurance rates. Insurers assess your record to gauge your risk level. If you have a history of accidents, speeding tickets, or other traffic violations, you can expect to pay significantly higher premiums. Conversely, maintaining a clean driving record can help you secure lower rates. For young drivers, demonstrating responsible driving behavior is essential to obtaining the best car insurance in Oregon.

For instance, a speeding ticket in Oregon can result in a significant increase in insurance premiums. The severity of the violation, the location, and the driver’s history will all factor into the rate increase. In some cases, a single speeding ticket can lead to an increase of 20% or more in annual premiums. While a history of traffic violations can increase premiums, some insurance companies offer forgiveness programs for minor offenses. These programs may allow drivers to have a single traffic violation removed from their record after a certain period without a significant impact on their insurance rates.

Credit Score

In Oregon, insurers are allowed to consider your credit score when determining your car insurance rates. Studies have shown that individuals with poor credit scores tend to file more claims, leading to higher premiums. If you have a good credit score, you can often secure better rates. Conversely, drivers with poor credit can expect to pay significantly higher premiums—often around $834 more per year than those with good credit. If you’re working to improve your credit, be sure to shop around and compare quotes from multiple providers.

Studies have shown a strong correlation between credit score and insurance claims. A 2023 study by the Insurance Information Institute found that drivers with credit scores below 600 are almost twice as likely to file a claim compared to those with scores above 700.

Vehicle Type

The type of vehicle you drive can also impact your insurance costs. Sports cars, luxury vehicles, and high-performance models typically cost more to insure due to their increased risk of theft and higher repair costs. For example, the average annual cost for a full coverage policy on a Ford Mustang is around $902, compared to $893 for a more standard Toyota Camry. When choosing a vehicle, consider how it may affect your insurance rates, as opting for a safer, more reliable car can lead to lower premiums.

Location

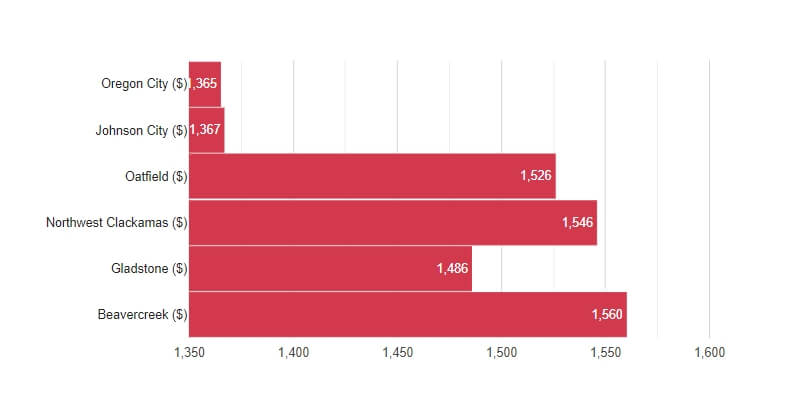

Your location within Oregon can significantly influence your car insurance rates. Premiums can vary based on your city or ZIP code, with areas that have higher accident, theft, or vandalism rates generally seeing higher costs. For instance, urban areas may have higher premiums compared to rural regions due to increased traffic and accident likelihood. It’s essential to consider your location when searching for cheap Oregon car insurance and to compare rates from different insurers based on your area.

Cheap Car Insurance Oregon: Affordable Providers for Young Drivers

1. https://hidanang.vn/mmoga-finding-the-top-real-estate-agents-in-your-area-a-comprehensive-guide

2. https://hidanang.vn/mmoga-cheap-car-insurance-houston-find-the-best-rates-for-your-budget

3. https://hidanang.vn/mmoga-cheap-car-insurance-arizona-tips-for-affordable-rates-in-2024

4. https://hidanang.vn/mmoga-the-best-car-insurance-in-michigan-find-affordable-coverage-today

5. https://hidanang.vn/mmoga-unlock-the-cheapest-car-insurance-in-missouri-a-comprehensive-guide

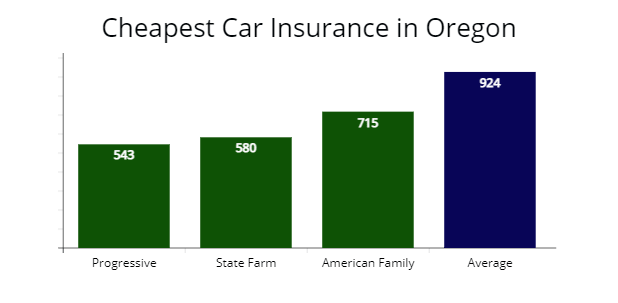

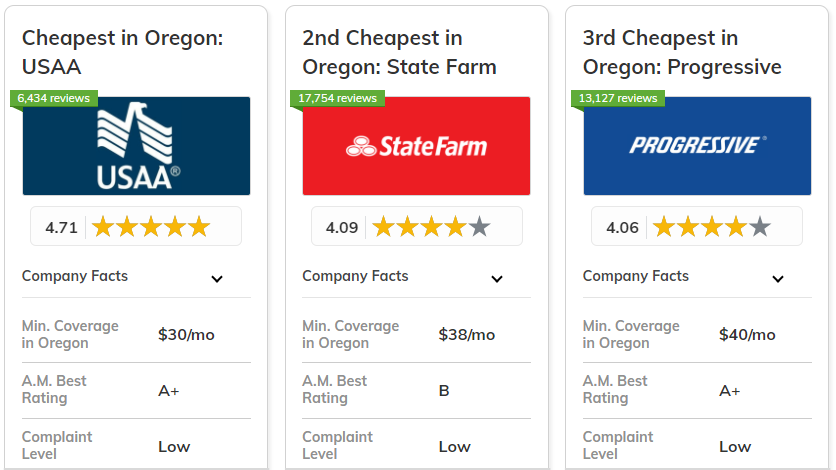

When it comes to finding the best cheap car insurance in Oregon as a young driver, a few providers stand out for their competitive rates and favorable coverage options:

Country Financial

Country Financial is known for its competitive rates and wide range of discounts, making it an excellent choice for young drivers in Oregon. A full coverage policy for an 18-year-old can cost around $250 per month, significantly lower than the state average. Additionally, Country Financial offers various discounts, including those for safe driving and good student performance, making it easier for young drivers to save on their premiums. Country Financial utilizes the Drive Safe and Save program, which uses a telematics device to track driving behavior and provide discounts for safe drivers.

State Farm

As one of the largest and most well-established insurers in the country, State Farm is a top choice for young drivers in Oregon. With an average full coverage rate of $305 per month for an 18-year-old, State Farm’s pricing is consistently among the best in the state. Beyond competitive rates, State Farm provides excellent customer service and a user-friendly mobile app, making it easy for young drivers to manage their policies.

American Family

American Family Insurance is another provider that excels at offering cheap car insurance for young Oregonians. Their full coverage policies for teen drivers typically range from $288 to $920 per year, depending on the driver’s age and other factors. American Family is also known for its commitment to customer satisfaction and offers a variety of coverage options tailored to the needs of young drivers.

Other Affordable Options

In addition to the companies mentioned above, several other insurers offer competitive rates for cheap car insurance in Oregon. These include:

- Geico: Known for its low rates and strong online presence, Geico is a popular choice among young drivers seeking affordable coverage.

- Progressive: With its innovative pricing tools and customizable policies, Progressive offers competitive rates for young drivers.

- Liberty Mutual: Known for its extensive range of coverage options and discounts, Liberty Mutual can be a good option for young drivers looking for affordable rates.

By comparing quotes from these insurers and others, you can ensure you’re getting the best possible rate for your car insurance needs in Oregon.

Tips for Finding the Cheapest Car Insurance as a Young Driver in Oregon

While the insurance companies mentioned above are a great starting point, there are additional strategies you can employ to further optimize your car insurance costs in Oregon:

Consider Joining a Family Policy

One of the most effective ways to save on car insurance as a young driver is to be added to a family member’s existing policy. This can result in significant cost savings compared to purchasing a standalone policy. The key is to compare the potential increase in your parents’ or guardians’ premiums against the cost of an individual policy. Being part of a family policy often provides access to lower rates and additional discounts.

Take Advantage of Discounts

Insurance providers in Oregon offer a variety of discounts that can help lower your car insurance rates. Some common discounts include:

- Good student discount: Maintaining a B average or higher can earn you a discount.

- Safe driver discount: Avoiding accidents and traffic violations can make you eligible for reduced rates.

- Defensive driving course discount: Completing a state-approved defensive driving course can lead to savings.

- Multi-car discount: Insuring multiple vehicles on the same policy can result in lower overall costs.

Be sure to ask your insurance agent about all the potential discounts you may qualify for. Taking advantage of these discounts can lead to substantial savings on your premiums.

Maintain a Clean Driving Record

One of the most effective ways to keep your car insurance rates low in Oregon is to maintain a clean driving record. Avoiding accidents, speeding tickets, and other violations will help you secure the best possible rates, as insurers view safe drivers as lower-risk. If you do find yourself with a blemish on your record, such as a speeding ticket or at-fault accident, consider taking a defensive driving course. This can demonstrate your commitment to safe driving and potentially mitigate the impact on your insurance costs.

Shop Around and Compare Quotes

Shopping around and comparing quotes from multiple insurers is crucial to finding the best car insurance in Oregon. Rates can vary significantly between companies, so taking the time to gather quotes can help you identify the most affordable options. Use online comparison tools to streamline the process and ensure you’re considering a range of providers.

Explore Usage-Based Insurance Programs

A recent trend in Oregon is the growing adoption of telematics devices, also known as ‘black boxes,’ by insurance companies. These devices track driving behavior, such as speed, braking, and mileage. Drivers with safe driving habits can often earn discounts on their premiums based on the data collected by these devices. Usage-based insurance (UBI) programs are becoming increasingly popular in Oregon. These programs allow drivers to pay for insurance based on their actual driving habits. By using a telematics device or smartphone app, drivers can track their mileage, speed, and braking behavior. This data is then used to calculate premiums, potentially leading to lower costs for safe drivers.

1. https://hidanang.vn/mmoga-finding-the-top-real-estate-agents-in-your-area-a-comprehensive-guide

2. https://hidanang.vn/mmoga-cheap-car-insurance-houston-find-the-best-rates-for-your-budget

3. https://hidanang.vn/mmoga-unlock-the-cheapest-car-insurance-in-missouri-a-comprehensive-guide

4. https://hidanang.vn/mmoga-the-best-car-insurance-in-michigan-find-affordable-coverage-today

5. https://hidanang.vn/mmoga-cheap-car-insurance-arizona-tips-for-affordable-rates-in-2024

Frequently Asked Questions

What are the minimum car insurance requirements in Oregon?

Oregon law requires drivers to carry a minimum level of liability insurance. The minimum liability coverage requirements are $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $20,000 for property damage. However, many drivers choose to purchase higher limits for additional protection.

How can I lower my car insurance rates after a speeding ticket?

If you receive a speeding ticket, your insurance rates may increase. To mitigate the impact, consider taking a defensive driving course, which can demonstrate your commitment to safe driving and potentially help lower your premiums. Additionally, maintaining a clean driving record moving forward will help improve your rates over time.

Does my credit score affect my car insurance rates in Oregon?

Yes, in Oregon, insurers can consider your credit score when determining your car insurance rates. Drivers with poor credit scores typically pay higher premiums compared to those with good credit. If you’re working to improve your credit, be sure to shop around and compare quotes from multiple providers, as rates can vary widely based on credit history.

What is SR-22 insurance, and when is it required?

SR-22 insurance is a certificate that demonstrates you carry the minimum required insurance coverage. It is often required for drivers who have had their licenses suspended due to violations such as DUIs or repeated traffic offenses. If you’re required to file an SR-22, it’s essential to maintain continuous coverage to avoid further penalties.

Additional Considerations for Young Drivers in Oregon

As a young driver in Oregon, there are a few more factors to keep in mind when searching for the cheapest car insurance options:

The Impact of Credit Scores

In Oregon, insurers are allowed to consider your credit score when determining your car insurance rates. Drivers with poor credit scores can expect to pay significantly higher premiums, often around $834 more per year than those with good credit. If you’re working to improve your credit, be sure to shop around and compare quotes from multiple providers.

Insuring a Sports Car

If you drive a sports car or high-performance vehicle, you can expect to pay higher insurance rates in Oregon. The average annual cost for a full coverage policy on a Ford Mustang is around $902, compared to $893 for a more standard Toyota Camry. Be mindful of the vehicle you choose, as it can have a significant impact on your insurance costs.

Military Discounts

For young drivers with a military background, USAA offers some of the most affordable car insurance options in Oregon. As an insurer focused on serving the needs of active-duty personnel, veterans, and their families, USAA’s rates and discounts can provide substantial savings.

Conclusion

Finding cheap car insurance in Oregon as a young driver requires a strategic approach, but the effort is well worth it. By understanding the key cost factors, researching the best insurance companies, and taking advantage of available discounts, you can secure coverage that fits your budget without compromising on protection.

Remember to shop around and compare quotes from multiple providers to ensure you get the most affordable car insurance in the Beaver State. With the right information and a proactive mindset, you can navigate the car insurance landscape and find the coverage that best suits your needs as a young driver in Oregon. By making informed choices and utilizing available resources, you can achieve significant savings on your car insurance premiums while ensuring that you have the coverage you need on the road.