It’s easy to feel like finding cheap car insurance in Houston is a hopeless endeavor, but the truth is that a significant number of drivers in the city are likely overpaying for their coverage. The key to unlocking more affordable rates lies in a proactive approach: comparing quotes from a diverse range of insurance providers and strategically leveraging any discounts for which you qualify. By doing so, you can achieve substantial savings on your premiums without having to sacrifice the essential coverage you need.

Toc

This comprehensive guide is designed to help you navigate the often-intricate world of car insurance in Houston, Texas. We will equip you with the knowledge and strategies necessary to effectively compare insurance options, understand the factors that influence your rates in Houston, and identify the best ways to lower your premiums. Our goal is to empower you to find the most suitable and affordable car insurance coverage tailored to your specific driving profile and needs in the Houston area.

Understanding Texas Car Insurance Requirements for Cheap Car Insurance Houston

Before diving into the search for cheap car insurance in Houston, it’s essential to understand the legal requirements for car insurance in Texas. All drivers must carry liability insurance, which covers damages you may cause to others in an accident. The minimum liability coverage required in Texas includes:

- $30,000 for bodily injury per person

- $60,000 for total bodily injury per accident

- $25,000 for property damage per accident

Driving without this minimum liability insurance is illegal in Texas and can result in substantial fines. While liability coverage protects other drivers and their property, it does not cover damages to your own vehicle or any personal injuries you may incur.

Optional coverages

In addition to the mandatory liability coverage, you may want to consider optional coverages such as:

- Collision Coverage: This helps pay for damage to your vehicle if you collide with another car or object.

- Comprehensive Coverage: This provides protection for damages not related to collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This covers you in accidents involving drivers who lack sufficient insurance.

- Personal Injury Protection (PIP): This pays for medical expenses and lost wages for you and your passengers, regardless of fault.

The optional coverages you choose will depend on your driving habits, the value of your vehicle, and your financial situation.

Factors Affecting Car Insurance Rates

When searching for cheap car insurance in Houston, several key factors can influence your premiums:

Driving History

Your driving record is one of the most significant factors insurers consider. A history of accidents or traffic violations can lead to higher rates, while a clean driving record can help you secure lower premiums. In Texas, each traffic violation carries a specific number of points, which accumulate on your driving record. For instance, a speeding ticket could add 2 points, while a DUI conviction could add 6 points. The more points you accrue, the higher your insurance premiums may become. Insurers use a point system to assess risk, and a higher point total indicates a greater likelihood of future accidents.

Age and Gender

Statistics show that younger drivers and male drivers typically pay more for car insurance. Insurers often view these demographics as higher risk, which can result in elevated premiums.

Vehicle Type

The make, model, and year of your car significantly impact your insurance rates. Vehicles with advanced safety features may qualify for lower premiums, while high-performance cars often come with higher rates. Houston has a relatively high car theft rate, according to [Source Name] data from [Date]. This factor can influence your insurance premiums, as insurers consider the likelihood of theft when setting rates. Vehicles with advanced anti-theft systems or those considered less desirable to thieves may receive lower premiums.

Location

Your specific zip code and neighborhood can affect your insurance costs. Areas with higher crime rates or accident frequency may result in increased premiums.

Credit Score

Many insurers consider your credit score when determining rates. A higher credit score can lead to lower premiums, while a lower score may result in higher costs.

Coverage Level

The level of coverage you choose directly impacts your premiums. Opting for higher coverage limits or adding optional coverages will increase your costs.

Deductible Amount

Selecting a higher deductible can lower your monthly payments, but ensure you have enough savings to cover the deductible in case of a claim. However, it’s important to remember that a higher deductible means you’ll need to pay more out-of-pocket if you need to file a claim.

1. https://hidanang.vn/mmoga-unlock-the-cheapest-car-insurance-in-missouri-a-comprehensive-guide

2. https://hidanang.vn/mmoga-the-best-car-insurance-in-michigan-find-affordable-coverage-today

3. https://hidanang.vn/mmoga-finding-the-top-real-estate-agents-in-your-area-a-comprehensive-guide

4. https://hidanang.vn/mmoga-securing-the-cheapest-car-insurance-in-oregon-a-comprehensive-guide

5. https://hidanang.vn/mmoga-cheap-car-insurance-arizona-tips-for-affordable-rates-in-2024

By understanding these factors and taking proactive steps, you can potentially reduce your car insurance costs in Houston.

In recent years, the cost of car insurance in Texas has been steadily increasing. Several factors contribute to this trend, including rising repair costs, increased litigation, and higher medical expenses. These factors, coupled with the high number of uninsured drivers in the state, have led to higher premiums for insured drivers.

Comparing Car Insurance Companies in Houston

Finding the best car insurance in Houston requires comparing quotes from multiple insurance companies. Online comparison tools can simplify this process, allowing you to obtain quotes from reputable providers such as State Farm, Geico, USAA, Nationwide, and Progressive. When evaluating companies, consider not only the rates but also their customer service, claims handling processes, and financial stability.

Customer Service and Claims Handling

When comparing car insurance companies, it’s crucial to evaluate their customer service and claims handling reputation. An insurance company’s responsiveness and efficiency in processing claims can significantly impact your overall experience, especially during stressful situations like accidents. Look for insurers with high customer satisfaction ratings and positive reviews. Resources like the J.D. Power Auto Insurance Study can provide insights into an insurer’s performance. Claims handling encompasses several factors, including the ease of filing a claim, the speed of the claims process, and the fairness of the settlement. Top-rated insurers often offer 24/7 claims reporting and quick turnaround times.

Financial Stability

The financial stability of an insurance company should not be overlooked. Strong financial health indicates that the company can fulfill its obligations and pay out claims, even in cases of widespread damage or large-scale disasters. Independent rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s provide ratings that reflect an insurer’s financial strength. Choosing a financially stable company ensures that your claims will be honored and you won’t be left in a difficult situation due to the company’s inability to pay.

Discounts and Savings Opportunities

Insurance companies offer various discounts that can help reduce your premiums. Common discounts include safe driver discounts, multi-policy discounts (for bundling home and auto insurance), and discounts for vehicles with safety features like anti-lock brakes or airbags. Additionally, some insurers provide usage-based discounts through telematics devices that monitor your driving habits. Taking advantage of these savings opportunities can significantly lower your insurance costs.

Specific Tips for Houston Drivers

Given Houston’s unique driving environment, there are specific tips that can help you secure more affordable car insurance:

- Drive Safely: Maintain a clean driving record by adhering to traffic laws and avoiding accidents or violations.

- Secure Your Vehicle: Use anti-theft devices and park in secure, well-lit areas to reduce the risk of theft.

- Shop Around: Regularly compare quotes from multiple insurers to ensure you’re getting the best rate.

- Consider Usage-Based Insurance: If you don’t drive frequently, usage-based insurance policies can be a cost-effective option.

- Review and Update Your Coverage: Periodically review your coverage needs to ensure you have adequate protection without unnecessary extras.

By being proactive and informed, you can navigate the car insurance landscape in Houston and find a policy that balances cost with comprehensive coverage.

How to Save on Car Insurance in Houston

Saving on car insurance in Houston requires strategic planning and awareness of the available options. One of the most effective ways to save is by exploring all the discount opportunities that insurers offer. Combining policies, maintaining a clean driving record, and utilizing telematics are just a few of the ways to potentially lower your rates.

Bundle Your Policies

Many insurance companies offer significant discounts if you bundle multiple policies together. For example, if you purchase both your car and home insurance from the same provider, you might be eligible for a multi-policy discount. This not only simplifies your billing but also offers considerable savings.

Maintain a Clean Driving Record

Your driving history is one of the most critical factors that insurers consider when determining your premium. By avoiding accidents and traffic violations, you can maintain a clean driving record, which will generally result in lower premiums. Enrolling in a defensive driving course can also sometimes qualify you for additional discounts.

Use Telematics

Telematics devices monitor your driving habits, such as speed, braking, and mileage, to offer lower rates to good drivers. If you drive safely and infrequently, usage-based insurance programs might be a cost-effective option for you.

Opt for a Higher Deductible

Increasing your deductible—the amount you pay out-of-pocket before insurance kicks in—can lower your premiums. However, be sure to choose a deductible that you can comfortably afford in case of an accident.

Ask About Discounts

Don’t be afraid to ask your insurer about discounts you may qualify for. Each company has its own set of savings opportunities, so it’s worth inquiring and taking advantage of any potential discounts.

Frequently Asked Questions

1. https://hidanang.vn/mmoga-cheap-car-insurance-arizona-tips-for-affordable-rates-in-2024

2. https://hidanang.vn/mmoga-securing-the-cheapest-car-insurance-in-oregon-a-comprehensive-guide

3. https://hidanang.vn/mmoga-the-best-car-insurance-in-michigan-find-affordable-coverage-today

4. https://hidanang.vn/mmoga-unlock-the-cheapest-car-insurance-in-missouri-a-comprehensive-guide

5. https://hidanang.vn/mmoga-finding-the-top-real-estate-agents-in-your-area-a-comprehensive-guide

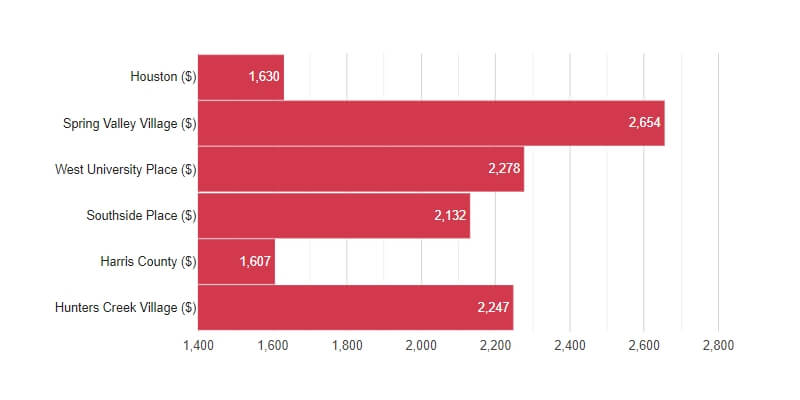

What is the average cost of car insurance in Houston?

The average cost of minimum coverage car insurance in Houston is approximately $74 per month or $893 per year. For full coverage, the average cost is about $224 per month or $2,687 per year.

How can I find a car insurance agent in Houston?

You can find reputable car insurance agents in Houston by using online directories, contacting insurance companies directly, or asking for referrals from friends and family. Many insurers have local agents and offices throughout the Houston area.

What are some of the best car insurance discounts available in Houston?

Some valuable discounts include the safe driver discount, multi-car discount, good student discount, anti-theft device discount, bundling discounts, and low mileage discounts. Be sure to explore all discounts you may qualify for to maximize your savings.

How can I lower my car insurance premiums after an accident?

Improving your driving record over time, shopping around for better rates, and taking advantage of available discounts can help lower your premiums after an accident.

What are the best ways to compare car insurance quotes online?

Use online comparison tools to obtain quotes from multiple providers, and consider factors such as coverage options, customer service, and financial stability when evaluating your options. Be sure to read customer reviews and compare rates for similar coverage levels. With these tips in mind, you can confidently navigate the process of securing affordable car insurance in Houston.

Conclusion

Securing affordable car insurance in Houston doesn’t have to be a daunting task. By understanding the various factors that influence your premiums and taking advantage of the discounts and savings opportunities available, you can find a policy that meets your needs and budget. Always remember to review your coverage periodically and remain proactive in seeking out the best rates. With diligent research and careful planning, you can navigate the car insurance landscape effectively.

In summary, whether you choose to bundle policies, maintain a clean driving record, use telematics, opt for a higher deductible, or ask about available discounts, there are numerous strategies to save on car insurance. Stay informed and proactive, and you’ll be well-equipped to secure a competitive and comprehensive car insurance policy in Houston.

Additional Resources

For further reading and additional resources, consider exploring the following:

- Texas Department of Insurance: Offers valuable resources and information about insurance regulations and consumer protections in Texas.

- Insurance Information Institute (III): Provides educational materials and insights into various types of insurance, including auto insurance.

- Consumer Reports: Features reviews and ratings for car insurance companies, helping you make an informed decision when choosing a provider.

- Local Community Workshops: Attend insurance workshops and seminars in Houston to stay updated on industry trends and best practices.

By leveraging these resources and staying informed, you’ll be better positioned to make sound decisions regarding your car insurance needs.