For teenagers in Arizona, the quest for car insurance presents a distinct challenge: balancing the need for affordable coverage with the necessity of essential protection on the road. While it’s a common perception that young drivers invariably face sky-high insurance premiums, the good news is that there are effective strategies to obtain cheap car insurance in Arizona. These strategies hinge on gaining a solid understanding of the various factors that insurance companies consider when setting rates and proactively taking advantage of any available discounts.

Toc

In this comprehensive guide, we will delve deeper into the specific nuances of car insurance in Arizona, with a particular focus on the elements that significantly influence your insurance premiums. We will also highlight some of the insurance companies that consistently offer the most competitive rates in the Arizona market. Furthermore, we will equip you with practical and actionable tips that you can implement to potentially save a considerable amount of money on your car insurance costs, ensuring you find a policy that is both affordable and provides the necessary protection for your needs as a young driver in Arizona.

Factors Affecting Car Insurance Costs in Arizona

Several key factors can impact the cost of car insurance for Arizona residents, especially for teen drivers. Understanding these elements can help you make informed decisions when shopping for coverage.

Driving Record

Your driving record is one of the most significant factors that insurance companies consider when determining your rates. A clean driving record with no accidents or traffic violations can help you secure lower premiums. In contrast, if you have a history of accidents, speeding tickets, or DUI convictions, you can expect to pay significantly higher rates.

For example, a single at-fault accident could result in a 15-20% increase in your premium, while multiple accidents or violations can lead to even higher rate hikes. Furthermore, insurance companies often utilize a points system, where each violation or accident accumulates points. These points can significantly impact your rates for several years, even after the incident.

Insurance companies typically review rates annually, so maintaining a clean record is essential to enjoy the benefits of lower rates.

Age and Experience

Age and driving experience are critical factors in determining car insurance rates. Statistically, teenage drivers are more likely to be involved in accidents compared to older, more experienced drivers. Consequently, insurance companies charge higher premiums for young drivers, particularly those under 25.

This surcharge, often called a “young driver surcharge,” typically lasts until you reach the age of 25, although some insurers may offer discounts for completing driver’s education courses or maintaining a clean driving record. As you gain more experience on the road and your age increases, you may notice a decrease in your insurance premiums.

Vehicle Type

The type of vehicle you drive can also affect your insurance rates. Cars that are expensive to repair or replace, such as luxury vehicles or high-performance sports cars, generally come with higher insurance premiums. Conversely, safe, reliable, and fuel-efficient vehicles tend to be cheaper to insure.

Before purchasing a vehicle, research its safety ratings and repair costs to make an informed decision. Vehicles equipped with advanced safety features, such as automatic emergency braking, lane departure warning systems, and adaptive cruise control, are often considered safer and may qualify for lower insurance rates. These features demonstrate a commitment to safety and can influence insurers’ risk assessments.

Location

Where you live in Arizona can also play a role in your car insurance rates. Urban areas, such as Phoenix, often have higher rates due to factors like increased traffic congestion and a higher risk of accidents or theft. In contrast, rural areas may have lower rates, as they typically experience fewer accidents and lower population density.

When shopping for car insurance, be sure to consider how your location may impact your premiums. If you live in a high-risk area, you may want to explore coverage options that can help mitigate those costs.

Coverage Levels

Understanding your insurance needs is crucial when selecting a policy. Arizona requires drivers to carry minimum liability coverage, which includes bodily injury and property damage liability. However, you may opt for additional coverage types, such as collision and comprehensive coverage, to better protect yourself and your vehicle.

While higher coverage levels typically come with higher premiums, they can provide peace of mind in the event of an accident. Consider your personal circumstances and how much coverage you truly need when selecting a policy.

Credit Score

In Arizona, your credit score can also influence your car insurance rates. Insurers often use credit scores to assess risk, with many studies showing a correlation between credit history and the likelihood of filing claims. Generally, drivers with better credit scores tend to pay lower premiums.

To maintain a good credit score, be sure to pay your bills on time, keep your credit utilization low, and avoid opening too many new accounts at once. This not only helps with your car insurance rates but can also benefit you in other areas of life, such as securing loans or mortgages.

Other Factors

Several additional factors can influence your car insurance rates, including marital status, gender, and driving habits. For example, married individuals often pay lower premiums than single drivers, as insurers view them as more responsible. Additionally, males typically face higher rates than females due to statistical data regarding accident rates.

Your driving habits, such as how often you drive and whether you engage in risky behaviors, can also impact your premiums. Insurers may offer discounts for safe driving or for those who drive fewer miles annually.

A recent trend in the insurance industry is the use of telematics, which involves tracking driving behavior through smartphone apps or in-vehicle devices. This technology allows insurers to assess individual driving habits and offer discounts to safe drivers. For example, a program called “Pay-Per-Mile” allows drivers to pay only for the miles they drive, potentially saving money for those who drive fewer miles.

1. https://hidanang.vn/mmoga-finding-the-top-real-estate-agents-in-your-area-a-comprehensive-guide

2. https://hidanang.vn/mmoga-unlock-the-cheapest-car-insurance-in-missouri-a-comprehensive-guide

3. https://hidanang.vn/mmoga-cheap-car-insurance-houston-find-the-best-rates-for-your-budget

4. https://hidanang.vn/mmoga-the-best-car-insurance-in-michigan-find-affordable-coverage-today

5. https://hidanang.vn/mmoga-securing-the-cheapest-car-insurance-in-oregon-a-comprehensive-guide

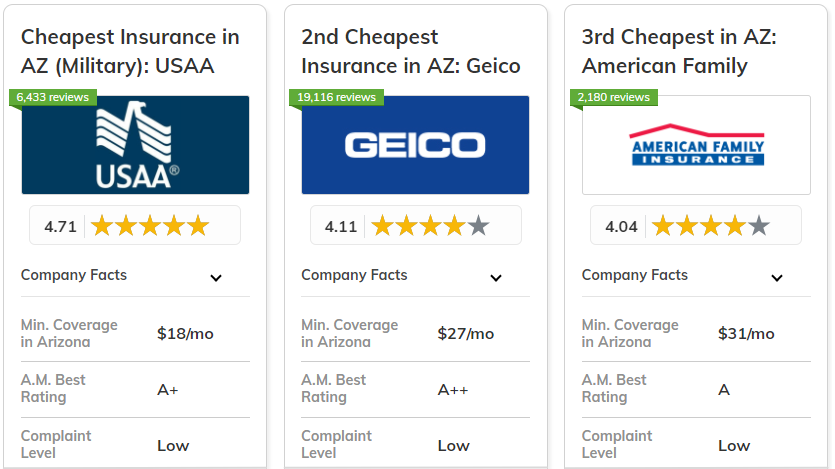

When it comes to finding the most affordable car insurance options for teens in Arizona, a few insurers stand out. Here’s a closer look at some of the top options available:

Geico

Geico is known for its highly competitive pricing, especially for young drivers. They offer a wide range of discounts, including good student and defensive driving discounts, making them a popular choice for Arizona teens. Geico’s user-friendly online platform allows you to easily manage your policy and access resources for saving money.

Pros:

- Competitive pricing for teen drivers

- Multiple discounts available

- Easy online management

Cons:

- Limited local agent availability for in-person support

- May lack some comprehensive coverage options

USAA

For military members, veterans, and their families, USAA typically offers some of the lowest car insurance rates in Arizona. Their exceptional customer service and varied coverage options make them an excellent choice for eligible families. USAA’s focus on serving military families sets them apart from other insurers.

Pros:

- Low rates for military families

- Excellent customer service

- Comprehensive coverage options

Cons:

- Membership is restricted to military personnel and their families

- Limited online tools compared to competitors

State Farm

While not always the absolute cheapest option, State Farm is a reliable insurer with a strong network of local agents in Arizona. They provide a variety of coverage options and discounts that can help teens find affordable car insurance. Their personalized service can be beneficial for those who prefer face-to-face interactions.

Pros:

- Extensive network of local agents

- Variety of coverage options

- Reliable customer service

Cons:

- Rates may not be the lowest for teen drivers

- Some online functionality is limited compared to fully digital insurers

Progressive

Progressive’s flexible coverage options, including usage-based insurance programs, can be beneficial for Arizona teens looking to save on their car insurance. Their Snapshot program tracks driving habits and rewards safe drivers with discounts. However, their rates may not always be the lowest in the state, so it’s important to compare them with other providers.

Pros:

- Flexible coverage options

- Usage-based insurance discounts

- User-friendly mobile app

Cons:

- Rates may vary significantly based on driving behavior

- Customer service quality can be inconsistent

American Family

American Family offers a wide selection of discounts, such as good student and defensive driving, which can help lower car insurance costs for teens in Arizona. Their customer service is generally well-regarded, though their rates may not be the absolute cheapest. They also provide various coverage options to suit different needs.

Pros:

- Multiple discounts available

- Positive customer service ratings

- Variety of coverage options

Cons:

- Rates may not be the lowest for all drivers

- Limited online functionality compared to some competitors

Other Affordable Options

In addition to the companies mentioned above, there are several other insurers in Arizona that offer competitive rates for car insurance. Companies like Farmers, Allstate, and Nationwide also provide various coverage options and discounts tailored to meet the needs of Arizona drivers. It’s worth taking the time to explore these options and compare quotes to find the best deal.

While it’s tempting to prioritize the cheapest option, it’s essential to consider the level of coverage offered by each insurer. Some companies may offer lower rates but have limited coverage options or higher deductibles, which could leave you financially vulnerable in the event of an accident. It’s crucial to weigh the cost savings against the potential risks associated with inadequate coverage.

Tips to Save on Car Insurance in Arizona

To find the most affordable car insurance in Arizona, consider these strategies:

Compare Quotes

Don’t settle for the first quote you receive. Shop around and compare rates from multiple insurers to ensure you’re getting the best deal. Rates can vary significantly between companies, so taking the time to compare options can pay off.

Take Advantage of Discounts

Look for discounts such as good student, defensive driving, and usage-based insurance programs. These can significantly lower your car insurance premiums. For instance, many insurers offer discounts for good students, defensive driving courses, multi-car policies, and even for having safety features like anti-theft devices installed in your vehicle. It’s essential to inquire about specific discounts offered by each insurer, as they can vary significantly.

1. https://hidanang.vn/mmoga-securing-the-cheapest-car-insurance-in-oregon-a-comprehensive-guide

2. https://hidanang.vn/mmoga-cheap-car-insurance-houston-find-the-best-rates-for-your-budget

3. https://hidanang.vn/mmoga-unlock-the-cheapest-car-insurance-in-missouri-a-comprehensive-guide

4. https://hidanang.vn/mmoga-finding-the-top-real-estate-agents-in-your-area-a-comprehensive-guide

5. https://hidanang.vn/mmoga-the-best-car-insurance-in-michigan-find-affordable-coverage-today

Maintain a Clean Driving Record

Avoiding accidents, speeding tickets, and other violations is crucial for keeping your rates low as a teen driver in Arizona. A clean driving record demonstrates to insurers that you’re a responsible and low-risk driver, which can lead to better rates over time.

Choose a Safe and Affordable Vehicle

Select a mid-sized or smaller vehicle with good safety features, as these tend to be less expensive to insure for young drivers. Research the safety ratings and repair costs associated with different makes and models before making a purchase.

Increase Your Deductible

Raising your deductible can lower your monthly premium, but be sure you have enough savings to cover the higher out-of-pocket costs if you need to file a claim. For example, you might consider increasing your deductible from $500 to $1,000, which could result in a significant reduction in your monthly premium. However, it’s crucial to ensure you have enough savings to cover the higher out-of-pocket costs if you need to file a claim.

Pay Your Premium Annually

Many insurers offer a discount for paying your annual premium in full, rather than making monthly payments. If you can afford to pay upfront, this can be a smart way to save money on your insurance costs.

Consider Usage-Based Insurance

Participating in a usage-based insurance (UBI) program, where your insurer tracks your driving behavior through a mobile app or in-vehicle device, can lead to substantial discounts for safe driving habits. Usage-based insurance programs, often referred to as “UBI” or “telematics programs,” are becoming increasingly popular as they offer discounts based on driving behavior. These programs typically track factors like braking habits, speed, and time of day driving. Drivers who demonstrate safe driving habits can often earn significant discounts, making UBI a potentially cost-effective option.

Frequently Asked Questions

Q: What is the minimum car insurance coverage required in Arizona?

A: The minimum car insurance coverage required in Arizona is $25,000 per person and $50,000 per accident for bodily injury liability, and $15,000 for property damage liability.

Q: How can I get a free car insurance quote online?

A: Most car insurance companies in Arizona have user-friendly online quote tools that allow you to input your information and receive a free quote within minutes. This makes it easy to compare rates from multiple insurers.

Q: What are some common discounts for drivers in Arizona?

A: Common discounts available to Arizona drivers include good student, defensive driving, multi-vehicle, and usage-based insurance discounts.

Q: How can I find the cheapest car insurance for my specific needs?

A: To find the most affordable car insurance that meets your needs, it’s essential to compare quotes from multiple insurers, take advantage of available discounts, and consider factors like your driving record, vehicle type, and coverage levels.

Q: What should I do if I have a bad driving record?

A: If you have a bad driving record, focus on improving your driving habits and maintaining a clean record moving forward. You can also look for insurers that specialize in high-risk drivers, as they may offer more competitive rates.

Conclusion

Finding cheap car insurance in Arizona as a teen driver doesn’t have to be a daunting task. By understanding the factors that influence rates, exploring the cheapest insurance providers in the state, and implementing smart strategies, you can secure affordable coverage that fits your budget and provides the protection you need.

Remember to shop around, compare quotes, and take advantage of available discounts to maximize your savings. With the right approach, you can navigate the Arizona car insurance landscape and find the perfect balance of cost and coverage for your unique situation.

Whether you’re a new driver or have a few years of experience, the right insurance policy can provide peace of mind as you hit the road. Prioritize safety, maintain good driving habits, and continuously seek opportunities to reduce your premiums. With diligence and research, you can achieve the best possible rates on cheap car insurance in Arizona.