Finding affordable car insurance in Missouri can be a daunting task, especially for young drivers. The average 16-year-old driver in the state can expect to pay around $3,348 per year for a full coverage policy, a significant financial burden for those just starting out. However, with the right strategies and a little know-how, you can navigate the Missouri insurance landscape and secure the cheapest car insurance options tailored to your specific needs. In this guide, we’ll explore the ins and outs of car insurance in Missouri, from understanding state requirements to identifying the best companies and tips for saving money.

Toc

- 1. Understanding Missouris Car Insurance Requirements

- 2. Factors Affecting Car Insurance Costs in Missouri

- 3. Shopping for Car Insurance in Missouri

- 4. Related articles 01:

- 5. Tips for Young Drivers to Save on Car Insurance in Missouri

- 6. Related articles 02:

- 7. Frequently Asked Questions

- 8. How Location Affects Car Insurance Rates in Missouri

- 9. Conclusion

Understanding Missouris Car Insurance Requirements

In Missouri, all drivers, including young adults, must carry minimum liability insurance coverage. The state mandates that drivers maintain at least:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident.

- Property Damage Liability: $25,000.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): $25,000 per person and $50,000 per accident.

While this minimum coverage might seem affordable, it’s crucial to understand that it solely protects other drivers in the event of an accident, leaving your own vehicle uninsured. For young drivers, especially those financing or leasing a car, full coverage policies that include comprehensive and collision insurance are often recommended. These additional coverages can provide vital financial protection for repairs or replacement if you’re involved in an at-fault accident.

Importance of Full Coverage

Full coverage insurance typically includes both comprehensive and collision coverage. Comprehensive insurance protects against non-collision-related incidents, such as theft, vandalism, or natural disasters, while collision insurance covers damage to your vehicle resulting from a collision with another vehicle or object. For young drivers, particularly those with new or financed vehicles, having full coverage is a wise decision. It may cost more upfront, but it can save you from significant financial strain in the event of an accident.

Understanding Your Cheap Car Insurance Missouri Policy

Your location in Missouri can have a significant impact on your car insurance costs. Urban areas typically experience higher premiums due to increased accident rates and higher theft rates. For example, drivers in St. Louis may pay around $1,270 per year for full coverage, while those in Columbia average just $890.

Factors Affecting Car Insurance Costs in Missouri

As a young driver in Missouri, several key factors influence your car insurance rates. Understanding these factors can help you make informed decisions when shopping for coverage.

Age and Driving Experience

Your age and driving experience are significant determinants of your insurance rates. Insurance companies categorize drivers into risk pools based on factors like age, driving experience, and driving record. Younger drivers, particularly those under 25, are often placed in higher-risk pools due to their statistical likelihood of being involved in accidents. This higher risk translates to higher premiums for young drivers compared to older, more experienced drivers. For instance, a 16-year-old driver in Missouri might pay an average of $3,348 per year, while a 22-year-old could expect around $1,146 for full coverage. As you gain more driving experience and maintain a clean record, your rates are likely to decrease.

Driving Record

Your driving record plays a crucial role in determining your insurance costs. Accidents, speeding tickets, and DUI convictions can lead to substantial premium increases. Maintaining a clean driving record not only helps you secure lower rates but also demonstrates to insurers that you are a responsible driver. If you do receive a traffic violation, consider taking a defensive driving course, which some insurers may recognize and offer discounts for.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance costs. Insurance companies consider factors such as the make, model, and safety features of your vehicle. Sports cars and luxury vehicles typically have higher repair and replacement expenses, leading to increased premiums. Conversely, opting for a reliable sedan like a Honda Civic with its high safety ratings and proven reliability can help you save on insurance costs.

Credit Score

Your credit score can also influence your car insurance rates. Many insurers use credit scores as part of their risk assessment process, with lower scores often resulting in higher premiums. Maintaining a good credit score (typically 650 or above) can help you qualify for lower insurance costs. However, this practice is controversial, and some argue that it unfairly penalizes individuals with limited credit history or those who have faced financial hardship.

Shopping for Car Insurance in Missouri

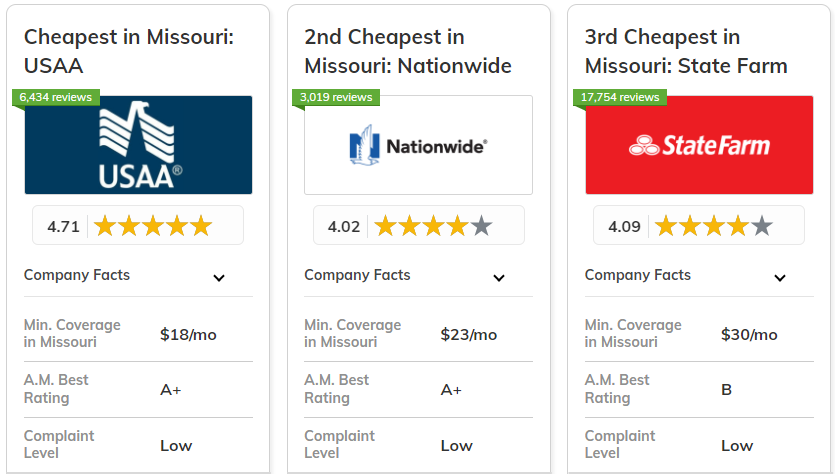

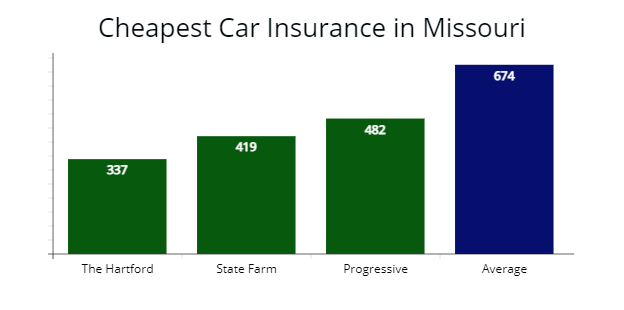

When searching for affordable car insurance in Missouri, it’s essential to compare quotes from multiple insurers. Here are some of the cheapest car insurance companies in the state for various driver profiles:

Travelers

Offering an average full coverage premium of $1,146 per year for drivers aged 22-29, Travelers consistently ranks among the most affordable options in Missouri. Their competitive pricing and variety of coverage options make them a solid choice for young drivers.

1. https://hidanang.vn/archive/2151/

2. https://hidanang.vn/archive/2150/

3. https://hidanang.vn/archive/2287/

American Family

American Family provides an average full coverage rate of $1,062 per year for young adults. This insurer is known for its excellent customer service and comprehensive coverage options, making it another top contender for budget-conscious drivers.

USAA

While only available to military members and their families, USAA offers the lowest minimum coverage rates for teenage drivers in Missouri, averaging just $668 per year for 18-year-olds. Their commitment to serving military families often translates to exceptional customer service and competitive rates.

Progressive

Progressive is known for its competitive pricing and innovative insurance solutions. They offer an average full coverage premium of $1,979 per year for drivers in their 20s. Progressive also provides various discounts, making it an appealing option for young drivers looking to save on insurance.

Many insurance companies are now using artificial intelligence (AI) to analyze vast amounts of data and personalize insurance quotes. This allows them to assess risk more accurately and offer more competitive rates to specific driver profiles.

Tips for Young Drivers to Save on Car Insurance in Missouri

As a young driver in Missouri, you can adopt several strategies to help keep your car insurance costs manageable:

Shop Around

Avoid settling for the first quote you receive. Take the necessary time to compare rates and coverage options from various insurers to identify the most advantageous deal.

Maintain a Clean Driving Record

Refrain from accidents and traffic violations to keep your insurance premiums low. Consider enrolling in a defensive driving course to demonstrate your commitment to safe driving, which may qualify you for discounts.

Choose Your Vehicle Wisely

Selecting a reliable and practical vehicle can significantly impact your insurance costs. Prioritize cars with high safety ratings and proven reliability.

Leverage Discounts

Many insurers provide discounts for factors such as good grades, safe driving, or being a student without regular access to a vehicle. Always inquire about potential discounts when seeking coverage.

Consider Usage-Based Insurance

Some insurance companies offer usage-based insurance (UBI) plans that adjust your rates based on your actual driving habits. This can be an excellent option for young drivers who may not drive frequently or practice safe driving habits.

Carpool or Use Public Transportation

Reducing your driving time can decrease your risk of accidents and lead to potential savings on insurance. Consider carpooling with friends or colleagues, or utilizing public transportation for your daily commute. Many insurers offer low-mileage discounts that can further reduce your premiums.

Invest in Safety and Anti-Theft Devices

Enhancing your vehicle with advanced safety features such as anti-lock brakes, airbags, and electronic stability control may qualify you for additional discounts. Similarly, installing anti-theft devices—such as alarms, immobilizers, and tracking systems—can lower the likelihood of theft and decrease your insurance costs.

Stay on Your Parents’ Policy

If you are a young driver, particularly a teenager or student, remaining on your parents’ car insurance policy is often more cost-effective than acquiring your own. Family plans typically offer lower rates, and some insurers provide discounts for multiple drivers under a single policy.

Regularly Review Your Policy

Insurance rates and offers can fluctuate frequently. Make it a practice to review your car insurance policy at least once a year and prior to renewal periods. Comparing new quotes and negotiating with your current provider can help secure a better rate or updated coverage that aligns with your current needs.

By implementing these strategies, young drivers in Missouri can better manage their car insurance expenses while ensuring they maintain the necessary coverage. Stay informed, drive safely, and continuously seek opportunities to save whenever possible.

1. https://hidanang.vn/archive/2150/

2. https://hidanang.vn/archive/2287/

3. https://hidanang.vn/archive/2152/

Frequently Asked Questions

Q: How much does car insurance cost for a 16-year-old in Missouri?

A: On average, a 16-year-old driver in Missouri can expect to pay around $3,348 per year for a full coverage policy when added to a parent’s existing plan. Individual rates may vary based on factors like the insurance company, driving record, and vehicle type.

Q: What are some common discounts for young drivers in Missouri?

A: Common discounts for young drivers in Missouri include good student, defensive driving, low mileage, and safety feature discounts. Bundling your auto insurance with other policies, such as homeowner’s or renter’s insurance, can also result in significant savings.

Q: What should I do if I get a speeding ticket or DUI in Missouri?

A: If you receive a speeding ticket or DUI in Missouri, it’s important to shop around for car insurance immediately, as these violations can significantly increase your premiums. Consider taking a defensive driving course, which may help mitigate the impact on your rates. In the case of a DUI, you may also need to obtain an SR-22 certificate to reinstate your driver’s license.

Q: Is it cheaper to insure a used car or a new car in Missouri?

A: Generally, it’s cheaper to insure a used car compared to a new car in Missouri. This is because used vehicles typically have lower repair and replacement costs, which translates to lower comprehensive and collision coverage premiums.

How Location Affects Car Insurance Rates in Missouri

Your location in Missouri can have a significant impact on your car insurance costs. Urban areas typically experience higher premiums due to increased accident rates and higher theft rates. For example, drivers in St. Louis may pay around $1,270 per year for full coverage, while those in Columbia average just $890.

Insuring a Sports Car or Luxury Vehicle in Missouri

If you own or are considering a sports car or luxury vehicle, it’s essential to understand how this choice affects your car insurance costs in Missouri. These types of vehicles usually incur higher repair and replacement expenses, which can lead to significantly higher comprehensive and collision coverage premiums. For instance, insuring a Ford Mustang in Missouri can cost around $179 more per year compared to a Toyota Camry. Always consider the insurance costs associated with a vehicle before making a purchase.

Additional Resources for Young Drivers in Missouri

If you’re a young driver in Missouri looking to navigate the car insurance landscape, several resources can provide valuable guidance:

- Missouri Department of Insurance : Visit their website at or call their consumer hotline at 800-726-7390 for assistance with insurance-related questions and complaints.

- Missouri Department of Revenue : Check their website at for information on SR-22 insurance requirements and other driving-related regulations.

- Online Insurance Comparison Websites : Platforms like allow you to quickly compare quotes from multiple insurers to find the best rates.

- Defensive Driving Course Providers: Search for approved defensive driving course options in your local area to potentially earn insurance discounts. Some insurers may also offer their own defensive driving courses for policyholders.

Conclusion

Finding affordable car insurance in Missouri as a young driver requires diligence, research, and strategic planning. By understanding the state’s insurance requirements, familiarizing yourself with the key factors that influence rates, and exploring the cheapest insurance companies and available discounts, you can navigate the process and secure coverage that fits your budget. Remember to shop around, maintain a clean driving record, and take advantage of all the money-saving opportunities available to you. With a little effort, you can unlock the cheapest car insurance options in Missouri and enjoy the freedom of the open road.